Corporate language pt 2. 👎🏼

Earlier, I wrote that the CEO of Robinhood, Vlad Tenev, uses ridiculous corporate language. It was on full effect during his interview with Elon Musk and in the Gamestop White House Financial Services Hearing.

Deviation

In both interviews, Vlad mentions that $GME’s sudden rise in price is a 5 sigma event. It’s an over-the-top way of saying an event that is 5 standard deviations from the norm in a normal (Gaussian) distribution. [1]

He also sometimes describes it as a “one in 3.5 million event”.

This was a five sigma Black Swan event (1 in 3.5 million), so basically model-breaking. Our daily VaR requirement increased from $282M to $1.4B in 1 day (see page 10 of my written testimony to the House Financial Services Committee https://t.co/QbOUyg3aSP)

— VLAD (@vladtenev) February 25, 2021

Here’s a refresher on standard deviations.

Intuition

The thing is, intuitively, you can just feel that GME’s rise in price is not a once in 3.5 million event.

It’s hard to tell what Vlad means. [2] It could be:

- In 3.5 million trading days, any stock rising this fast would happen once. (3.5m / 253 trading days in a year = once every 9,589 years)

- Of the 2,800 stocks on NYSE, this will happen once in 3.5 trading days. ( (3.5m / 365) / 2800 = once every 4.94 years) [3]

Neither of these makes sense.

Scenario #1

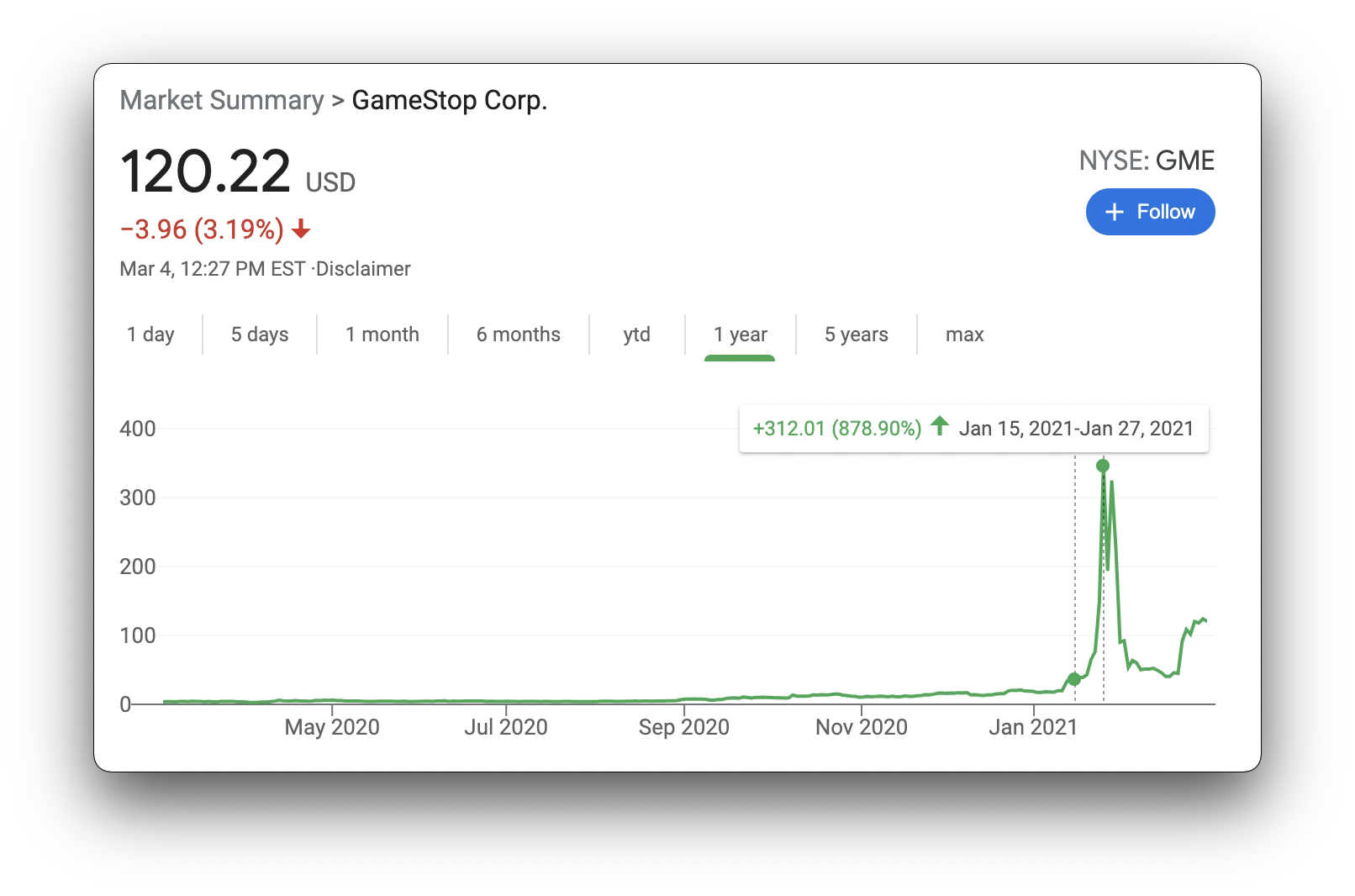

$GME rose a lot; but it wasn’t unheard of. On 1/15/2021, it was trading at $35.50.

Twelve days later on 1/27/2021, at its peak, it hit $347.51. A 878.90% increase.

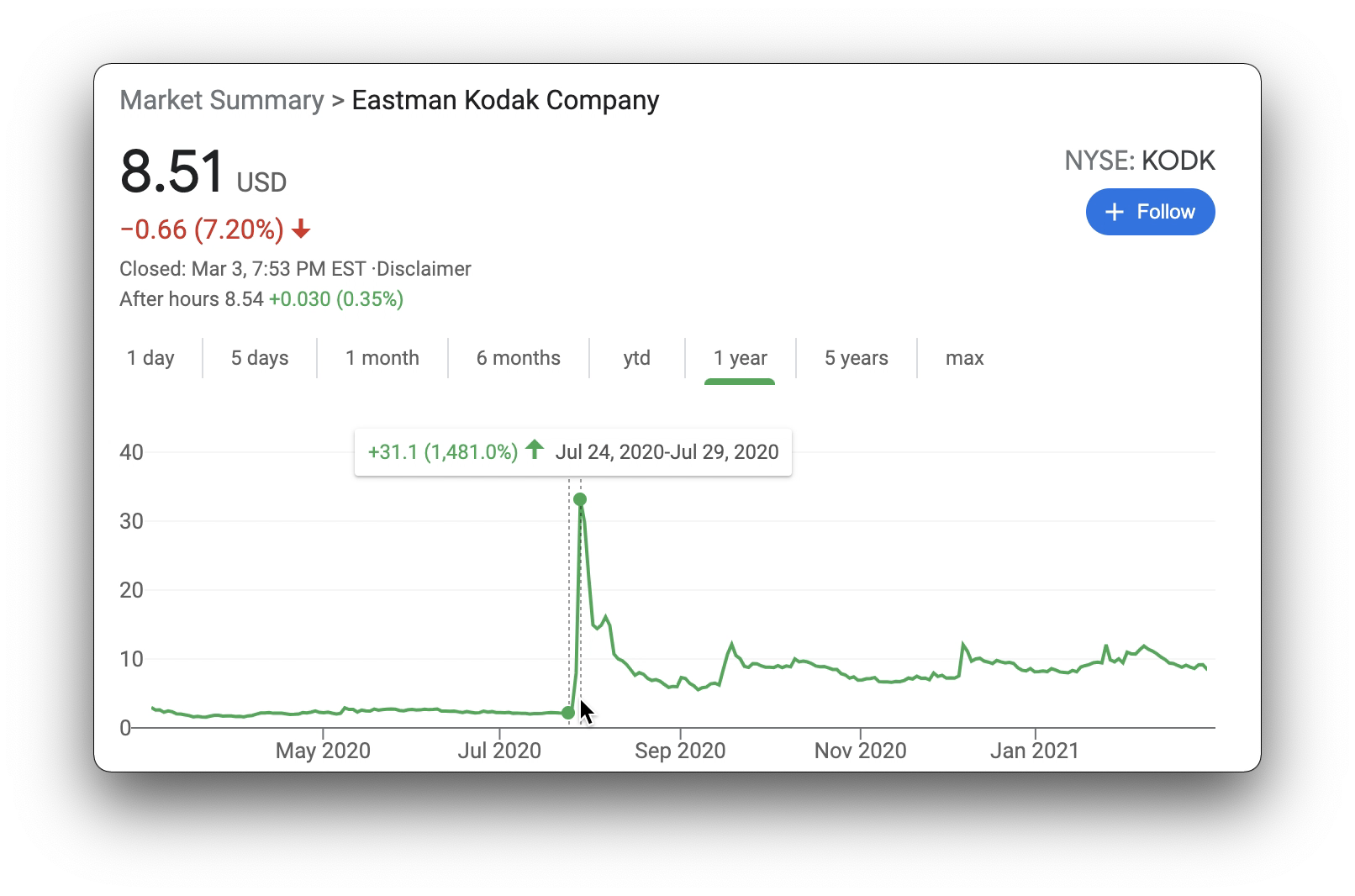

That’s a lot. But this happens all the time. Last year, Kodak had a bigger rise than Gamestop, and did it in 5 days.

Definitely not one in 3.5 million.

Scenario #2

At the other end of the spectrum: if an event happens every 5 years, you should be prepared for it. Full stop.

Nassim Nicholas Taleb Calls Him Out

In the tweet embedded above, Vlad says:

This was a five sigma Black Swan event…

Nassim Nicholas Taleb (NNT), who invented the term Black Swan, responds to Vlad’s tweet:

It was NOT 1 in 3.5 million!!!!

— Nassim Nicholas Taleb (@nntaleb) March 3, 2021

NNT then adds an explainer video:

Nassim’s Explanation

In summary, what the above video says is: you can only apply sigmas if you are certain you’re dealing with a perfectly gaussian distribution. [4]

If there’s any doubt that the outcomes are gaussian, when you see an unlikely (6 sigma event), it basically confirms to you that the distribution is not gaussian.

This is a version of Wittgenstein’s ruler. Think about it this way.

- You live in North America in year 500. You’ve only seen white swans.

- You believe all swans are white.

- A traveler brings a black swan from Australia, and shows you.

- You can either conclude:

- That is not a swan.

- Some swans are black.

In the stock market:

- You believe events in the stock market are a perfect normal (Gaussian) distribution.

- Gamestop rises up unexpectedly fast.

- If stock prices are normally distributed, that makes this a 5 sigma event.

- You can either conclude:

- This is truly a one in 3.5 million event.

- Stock prices are actually not a normal distribution.

The answer is swans are black; stock prices are not normally distributed, and prices change like this all the time.

It’s clear that:

- Vlad is intentionally using handwavy math to say he’s not responsible.

- Doesn’t understand the math.

[1] Using unnecessarily complex terms is a common thing bullshitters do.

[2] Intentionally being obscure is another common thing they do.

[3] This could also be some other cherry-picked stat by combining Gamestop’s market cap, trading value, and some other factors.

[4] NNT uses LTCM as an example. Their hedge fund blew up, and they claimed it was a 10 sigma event. If you are even only 99.9999% sure that it’s a normal distribution and you see a 10 sigma event, the likelihood that it’s actually 10 sigma is 2.03 x 10^-15.