Arbitrage strategy: Why interest rates so high. 🌴💨 (3/3)

Previously I wrote about my interest rate arbitrage method.

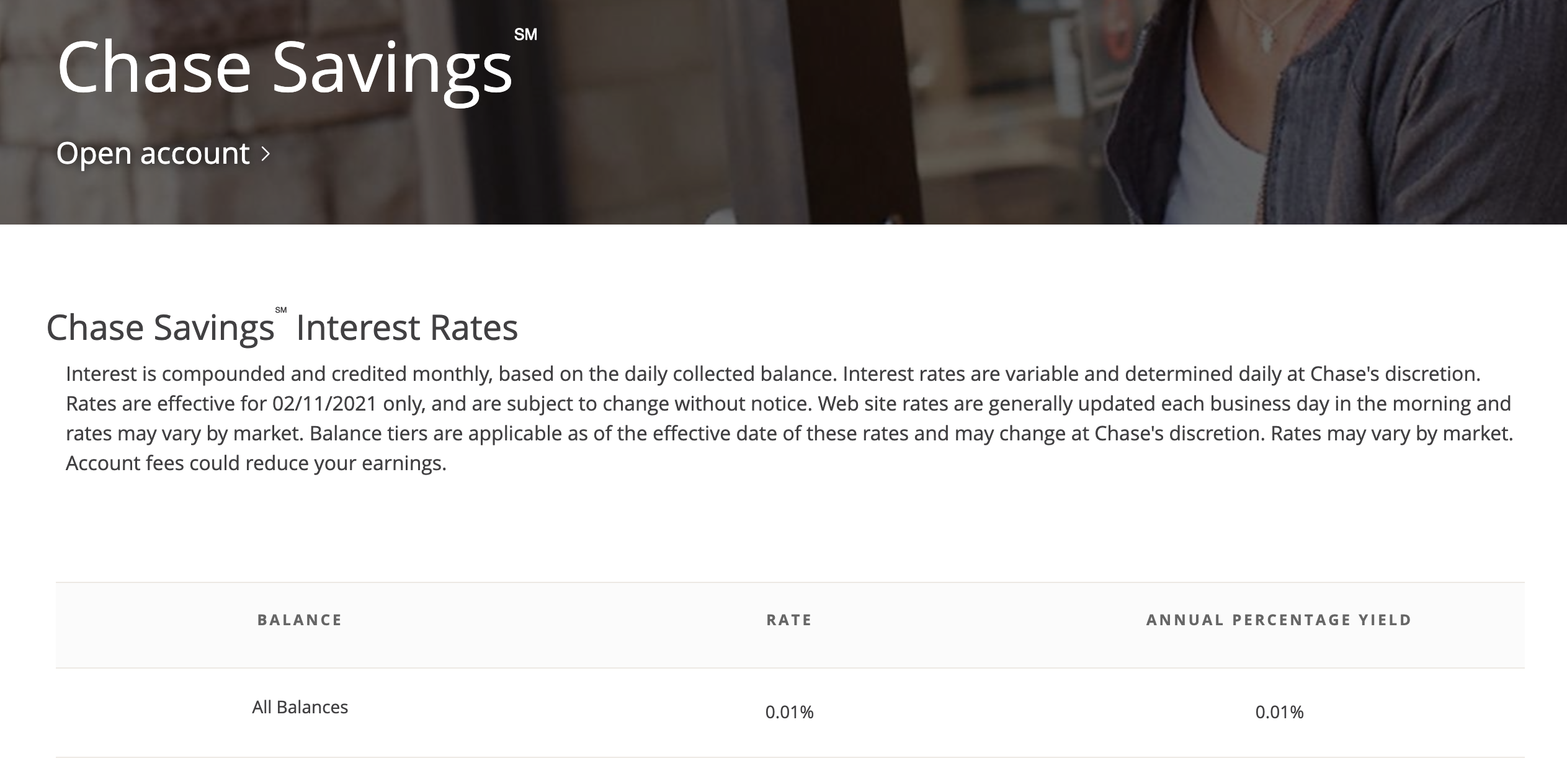

To recap, a bank savings account gives you 0.01% interest.

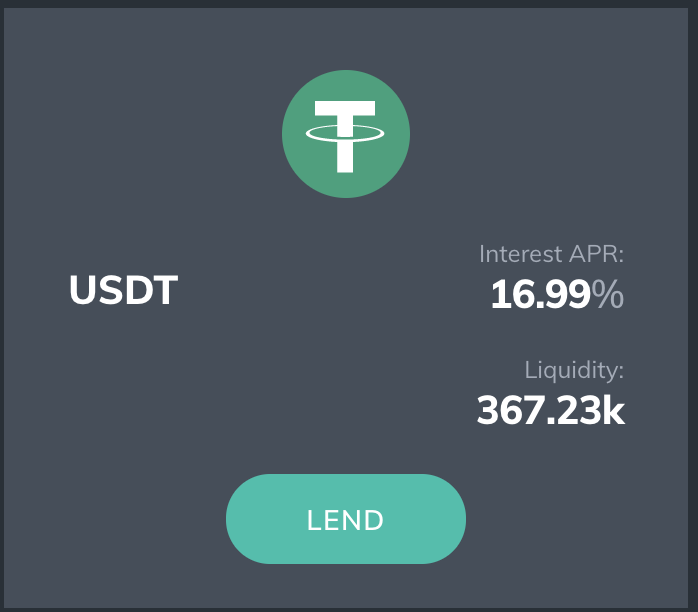

Lending out USDC or USDT (crypto stable coins that are guaranteed to always be worth $1 per coin), earns you something like 16.99% right now.

Meaning: if you have 100k stored at Chase for a year, you’ll have $100,010 at the end of the year. Using Fulcrum (pictured above), you would have $116,990.

Why the huge gap?

There are two reasons:

- If you’re bullish on crypto, it’s better to get a collateralized loan against your crypto than to sell it. Lots of people want these loans. [1]

- When volatility is high, traders increase leverage to speculate, and are willing to pay more.

1. Better to get a loan than to sell

Using Bitcoin (BTC) as an example, but this applies to all non-stablecoins and assets.

Everyone is encouraged to never sell Bitcoin. Even Warren Buffett says he buys companies he plans to never sell.

But if I never sell my Bitcoin or stock, how do I use it to buy stuff? The answer is: you get loans against your BTC (assets) as collateral.

That is a collateralized loan.

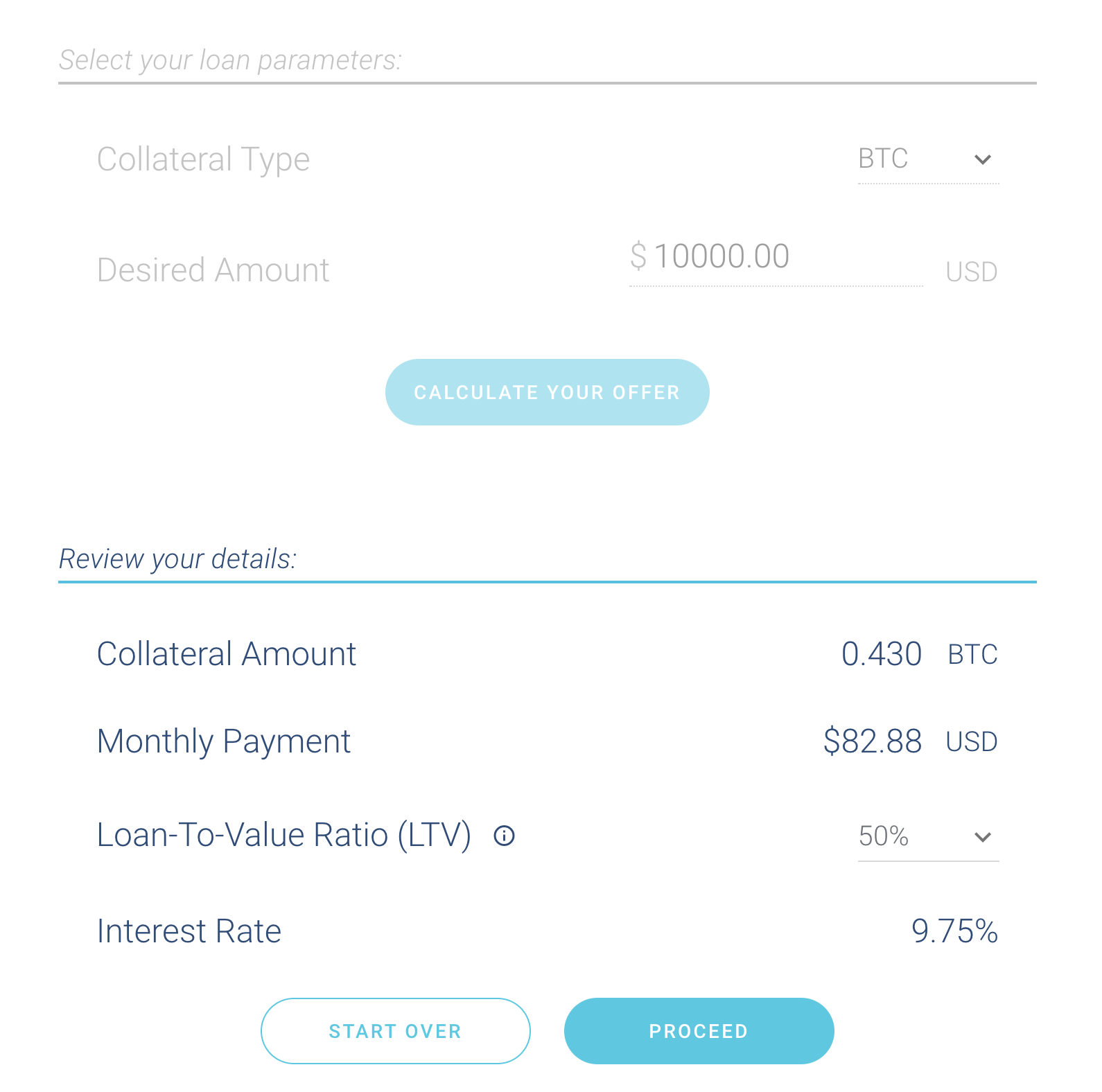

For example, BlockFi will loan you $10k at a 9.75% interest rate if you put up 0.43 BTC ($20,321 at time of writing) of collateral. Meaning, if you don’t pay back your loan, they will begin selling parts of your BTC to pay for your loan.

So, why is paying that 9.75% better than just selling BTC to pay for life? A hypothetical:

- On January 1st, 2020, a BTC holder has 142.2189 BTC worth $1,240,000. He lives a $120k / year lifestyle.

- To pay for his life, he can sell $120k worth of BTC each year.

- But, he pays the 15% long-term capital gains tax if he sells.

- Assumes best case, that he held the BTC over a year.

- That means, to actually get $120k after tax, he needs to sell 19.607 BTC worth $141,176.47.

- This costs him $21,176.47 (taxes).

- On Jan 1st, 2020, he sells that amount and is left with 122.6119 BTC worth $882,826.52.

- At year end (12/31/2020), BTC is worth $29,001.72. He has 122.6119 BTC worth $3,555,955.99.

With a collateralized loan:

- He puts up $240k in BTC to BlockFi.

- Gets a loan for $120k at 9.75%.

- Over the year, the loan will cost him $11,700.

- To cover that, on 1/1/2020, he sells 1.912 BTC worth $13,764.71 (has to pay the 15% long-term capital gains tax), and sets it aside.

- He now has 140.3069 BTC left.

- This costs him $2,064.71 in taxes.

- At year end (12/31/2020), his BTC is worth $4,069,141.43.

- To close out his loan (he still needs to pay back that $120k), he now sells 4.87 BTC worth the same $141,176.47.

- He now has 135.4369 BTC worth $3,927,903.05, a $371,947.06 difference.

This second scenario is massively better.

It can be even more dramatic in a few ways:

- Have him pay short-term capital gains in scenario #1

- In Scenario #2, use a 4:1 collateral ratio (put up 400k BTC to get 100k cash) to drop interest rate to 4.5%; way, way better.

- Have a business do #2; case is stronger because it’s taxed on profit, not income.

2. High volatility

In the above example, the lender is only getting 9.75%. How can the lender afford to give out 16.99%?

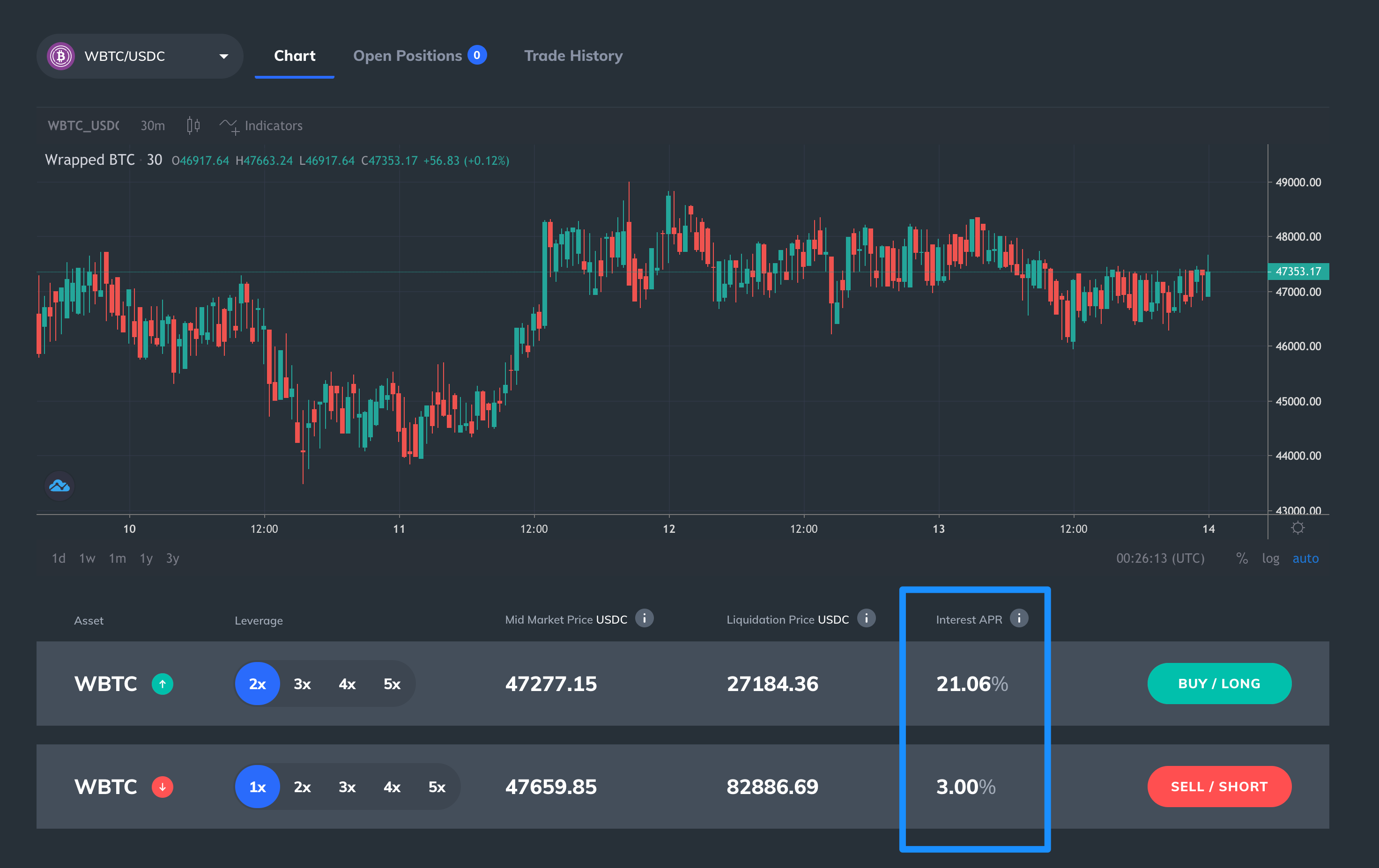

The more fickle but higher margin source of revenue for lenders is margin trading. When volatility increases, more people want to speculate. Volatility of Bitcoin is very high right now.

As of writing, people will pay 21.06% to speculate long on BTC:

Closing the loop

- Guy from Scenario #2 gives BlockFi $240k worth of BTC, BlockFi gives back $120k USD at 9.75% interest.

- BlockFi has $120k in value left.

- BlockFi lends out this $120k to speculator at 21.06% interest.

- At year-end, BlockFi gets $11,700 from Scenario #2 guy, and $25,272 from speculator for a total of $37,972.

Note: Above is over-simplified but directionally accurate. I’m aware; I don’t need comments picking it apart.

[1] The key here is “if you’re bullish on crypto”. This is just another form of leverage; if the price of BTC declined during the year, losses would be increased.